Just three months after Al Dintino and his family moved to North Carolina, Hurricane Florence was at their doorstep. The storm caused major damage to their home, uprooting the lives they had worked so hard to build.

Al never wanted to be unprepared again. He called up his old neighbor from Virginia - John Ingargiola - who happened to be FEMA’s Lead Physical Scientist and asked him: what would FEMA recommend? This began Al’s journey of both recovery and the rebuilding of his home.

Pictured: Al Dintino

The first step to protecting his home was to learn and understand more about the hazard risks his area faces. The Dintino family knew from first-hand experience that for them, the risks were hurricanes, specifically high winds and flooding these storms can bring.

Once the risks in their area were identified, they began to examine building codes in their state to help them make a more informed decision on how to rebuild. FEMA tools such as Building Code Adoption Tracking (BCAT) fact sheets can help analyze more closely the local risks and building codes in each state. This helps determine what kind of materials and methods are recommended to make a house sustainable and strong.

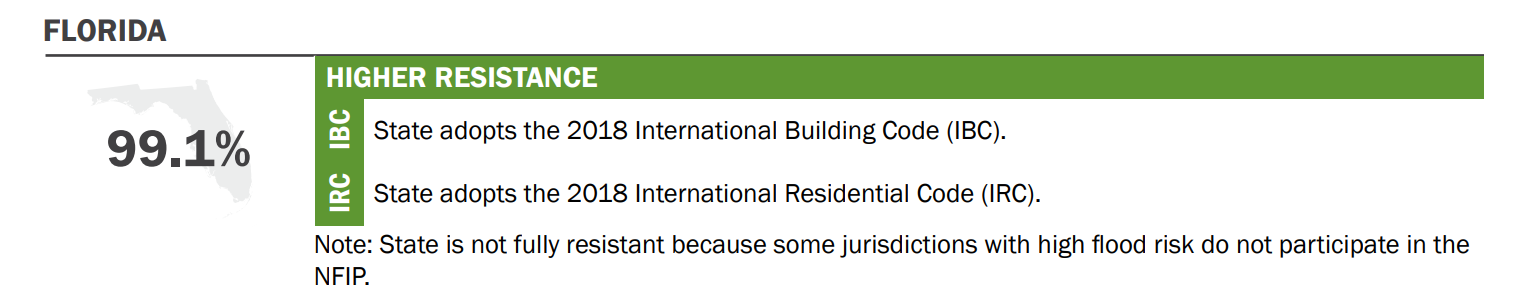

The above fact sheet shares information about how the building code standards are more current, such as this example from Florida. It also provides you with the codes that each state follows. With this information, the next step is to visit FEMA’s partner, the International Code Council website. This provides a breakdown of these building codes and what it means for a local community and its residents.

The building codes in Al’s area helped him decide on the best way to rebuild. FEMA Partners, such as the Federal Alliance for Safe Homes (FLASH) can also help you understand your building codes. FLASH conducted the Building Code Consumer Awareness Research and Outreach Project in 2019, which illustrates why there is still an enormous gap in code adoption and enforcement. The study found that eight of ten respondents assumed they were adequately protected by building codes, even though only one-third of U.S. communities have adequate codes in place to protect against disasters.

The tools offered by FLASH are able to provide a break down on how to protect your home, including more information on:

- Emergency Board Up

- Flood and Hurricane Home Retrofits

- Sandbags

- Shutter Options

- Strengthen Your Garage Door

- Strengthen Your Gutters

- Strengthen Your Roof

Another great resource for finding ways to protect your home, especially if you know a hurricane or another disaster might be on it’s way, is Ready.gov. The site shares ways you can implement simple steps to protect your home, like covering windows with hurricane shutters or securing outdoor objects to prevent damage.

Al knew that another big step he could take was to raise the height of his house. The elevation of his house would mean a more secure home and a significant drop in the cost of his flood insurance. They decided to raise the house’s elevation by 4 feet, so the house now stands 6 feet off the ground.

In this video, hear Al discuss the process of elevating his home.

Flood insurance was the final piece of the puzzle for Al. Despite the measures that Al took to protect his home from disasters, he knew flooding would remain a risk. This was in large part because he lives close to a river and creek. When Hurricane Florence hit, the surge from the storm caused flooding in his house. Al was grateful that, before the hurricane hit, he had taken time to look at flood maps and invest in flood insurance. After submitting a flood insurance claim, he was able to recover some of the losses. This experience reinforced to him that flood insurance was worth it.

After his house was repaired, retrofitted and constructed using modern building codes, and with flooding in mind, he maintained flood insurance coverage. The work done on his house to protect it from flooding resulted in his annual flood insurance premium lowering from nearly $2,000 down to $400.

FEMA continues to make changes to the National Flood Insurance Program to benefit people like Al, who have worked to make their houses stronger. The agency recently updated the National Flood Insurance Program risk rating system, now called Risk Rating 2.0 – Equity in Action, with this goal of lowering premiums for households and communities that work to adopt building codes and take other sustainability actions. You can use the Risk Rating 2.0 state profiles to understand more ways that this new system could lower your premium.

The measures Al has taken to protect his family and his home, means that hurricane season comes and goes with less stress and worry. When Hurricane Dorian hit in 2019 the houses in their neighborhood experienced damages, but his house remained tall and strong. The Dintino family was ready– and so was their home.

The Dintino house before the elevation.

The Dintino house after the elevation.