FEMA works with federal, state, tribal, and local partners to identify flood risk and update flood maps and Flood Insurance Studies, which can be a multi-year effort that goes through several phases.

One phase involves delivering preliminary flood maps to the communities for their review and comments. This webpage provides information on how to:

Identify Your Risk

Review the Impacts on Your Flood Insurance

Understand the Options if You Disagree

Identify Your Risk

Flood risks change over time. Water flow and drainage patterns can change dramatically due to environmental changes, land use and other forces. Consequently, the likelihood of flooding can also change. However, older flood hazard maps may not reflect these changes; many areas have not been studied to determine the flooding risk.

What do the current flood maps say about my flood risk? The National Flood Hazard Layer (NFHL) is a geospatial database that contains current effective flood hazard data.

Based on new digital mapping techniques, detailed, reliable, and current information on county and local community flood hazards is now available on updated flood hazard maps. These new preliminary flood maps present a better picture of the areas most likely to be impacted by flooding and provide a better foundation for making important building, land use, and flood insurance decisions.

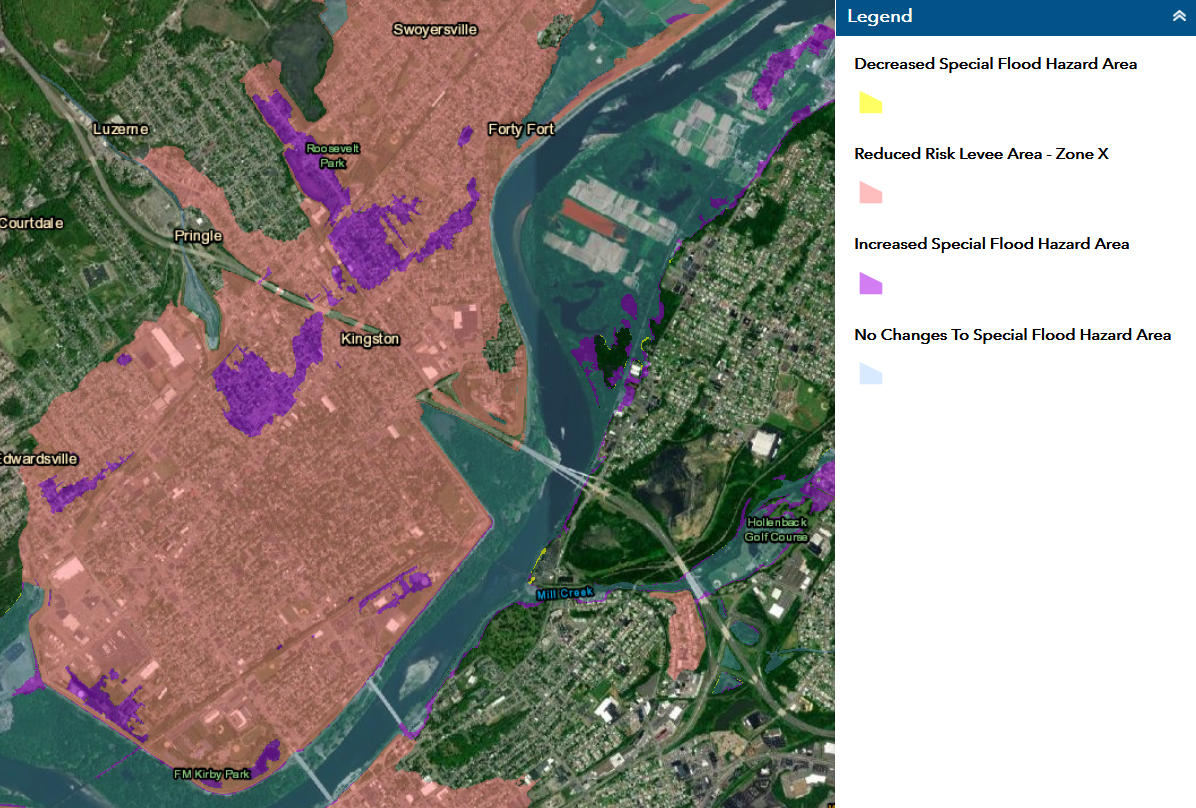

Flood Map Changes Viewer (FMCV)

Property owners need to know how the flood risk may have changed for their property. FEMA's Flood Map Changes Viewer (FMCV) shows what areas have increased in flood risk and which ones have decreased on the new preliminary flood map.

Download tips and instructions for using the tool.

Go to the Flood Map Changes Viewer

Flood Map Open Houses

Flood Map Open Houses show residents how the preliminary version of their updated flood map may affect their property and then connects them with available support resources.

Find an Upcoming Open House

Potential Impacts of Map Changes on Flood Insurance

When flood maps are updated, some residents and business owners may find that their property’s flood risk now shown as higher or lower than before. Others may see no change. Some may now be required to carry flood insurance, while others will no longer have to. If you find that your flood risk has changed, it is important to know how that change may affect your requirement for and cost of flood insurance.

Check the different scenarios below, which include your options for reducing any financial impacts. You can also download a summary fact sheet.

From Moderate-to-Low-Risk to High-Risk

If your home or business is newly identified as being in a high-risk flood area, most lenders must require you to carry flood insurance. The NFIP offers a cost-saving flood insurance rating option called the Newly Mapped Procedure.

With this option, property owners who buy a policy within the first 12 months after an updated map becomes effective are eligible for the lower-cost Preferred Risk Policy (PRP). Rates will then go up no more than 18% each year until they reach a standard Zone X rate, or the rate based on the new flood map, whichever is cheaper.

From High-Risk to Higher-Risk Increase in Base Flood Elevation

If the flood risk is increasing and your property will be in a higher risk flood zone (e.g., Zone A to Zone X) or will have a higher Base Flood Elevation (BFE), the NFIP offers a cost-saving flood insurance rating option know as Grandfathering. Grandfathering allows property owners to “lock in” the lower risk flood zone or BFE for future rating.

The NFIP grandfathering rule allows policyholders who have a policy in effect before the updated maps become effective or have built-in compliance with the flood map in effect at the time of construction, to keep their previous flood zone or BFE to calculate their insurance rate. This can result in significant savings.

From High-Risk to Moderate-to-Low-Risk

If your property’s flood risk is decreasing from a high-risk area (Zone A) to a moderate- or low-risk area (Zone X), the federal requirement to carry flood insurance by lenders is removed; however, the flood risk is not… it is just reduced. About 25% of NFIP flood claims in the U.S. are from policyholders in the lower-risk Zone X.

The reduction in flood risk typically means flood insurance will be cheaper when the maps become effective. Residents and business owners are strongly encouraged to ask their insurance agent to convert their more expensive high-risk policy to the lower-cost Preferred Risk Policy and maintain coverage. No additional money is needed up front, and you will get a refund for the cost difference.

No Change in Flood Risk

While map updates will affect some property owners, many residents and business owners are not affected. However, this is a good time to review your flood insurance coverage with your insurance agent. Most homeowner policies do NOT cover damage due to flooding. When the updated maps go into effect, your property may be closer to a high-risk area than before. About 25% of NFIP flood claims in the U.S. are from policyholders in Zone X.

If you have a flood insurance policy, talk with your insurance agent to see if you are fully insured to receive replacement cost for your home and that you have contents coverage. If you don’t have flood insurance, you may qualify for the lower-cost Preferred Risk Policy, which automatically includes contents coverage

Options If You Disagree with the Preliminary Flood Maps

When a preliminary flood map is issued and you disagree with the new flood risk identified for your property, you have two ways to try to amend it:

Steps to Amend a Preliminary Flood Map

1. FEMA works with communities to update the Flood Insurance Study (FIS) and Flood Insurance Rate Map (FIRM)

2. Preliminary study and updated map issued (FIS & FIRM)

3. Community virtual open house and online outreach

4. Public review: Appeal and comment period (90 days)

7. New Flood Insurance Rate Map (FIRM) goes into effect

5. Community receives Letter of Final Determination

6. Six-month compliance period

Appeals and Comments

When a preliminary flood map becomes available, some residents, business owners, developers and others may disagree with the flood risk shown in certain areas. FEMA provides a 90-day appeal and comment period for new or revised Base Flood Elevations (BFEs), flood hazard zones, and or floodway boundaries. Members of the community have opportunities to submit evidence on why they believe their property has been improperly mapped. However, the evidence must be scientifically or technically based. Even if “it hasn’t flooded in a while (or ever),” technical analysis can show that the risk exists.

During the 90-day appeal and comment period, you can submit:

- An appeal, which is a formal written objection to a new or modified BFE, Special Flood Hazard Area (SFHA), floodway, or flood zone This must be supported by an analysis or scientific evidence showing that the information on the preliminary map is scientifically or technically incorrect.

- A comment, which points out changes needed for any other information related to the updated map (such as a street name or jurisdictional boundary).

After the appeal period, FEMA will evaluate the data in the appeals and comments and request additional data, as necessary. Once all appeals are resolved, FEMA will send an appeal resolution letter to the community and all appellants and revise the preliminary flood map as appropriate. After that, FEMA will finalize the flood map and send a Letter of Final Determination to each community, stating that the map will become effective in six months.

Letter of Map Changes (LOMCs)

Due to scale limitations, a preliminary map may inadvertently show a building (or part of it) within a high-risk flood zone (a Special Flood Hazard Area, or SFHA). When the updated maps become effective, property owners may submit mapping and survey information to FEMA to request a Letter of Map Amendment (LOMA) or a Letter of Map Revision Based on Fill (LOMR-F). The more precise details you provide may allow FEMA to officially change the building’s flood zone from an SFHA to Zone X, a moderate- to low-risk flood zone.

While this process may also remove the Federal Mandatory Purchase Requirement when they become effective – and your lender may no longer require flood insurance – it does not mean the risk of flooding has been removed; it is only reduced. You are strongly encouraged to continue to carry flood insurance with the lower-cost Preferred Risk Policy. More than 30% of flood claims in Arizona come from policyholders in moderate-low risk flood zones.

Letter of Map Change Resources

How to Request a Map Amendment (infographic)

How to Request a Map Amendment - Spanish (infographic)

How to Request a Letter of Map Amendment (LOMA) or Letter of Map Revision Based on Fill (LOMR-F)

Electronic Letter of Map Amendment (eLOMA)

For more information on LOMAs and LOMR-Fs, visit our Change Your Flood Zone Designation page.